As a college student, you’re likely juggling a multitude of responsibilities—classes, assignments, part-time jobs, and perhaps even dorm life. While it may seem that managing your credit is a concern for the distant future, establishing good credit habits during your college years can set you on a path to financial success. In this article, we’ll explore the importance of building credit in college and provide you with practical tips, insights, and strategies to help you do just that.

Why Building Credit in College Matters

Building credit is akin to constructing a solid financial foundation, and it’s essential for several reasons, even when you’re in college. Here are some compelling statistics and reasons to consider:

- Future Financial Opportunities: According to a 2023 report by Experian, 61% of college students believe that a good credit score will be crucial for their future financial goals, such as buying a car or a home. By starting early, you can ensure you have the creditworthiness to seize these opportunities when the time comes.

- Credit Card Debt Awareness: A study by Credit Karma found that 73% of college students feel more informed about credit card debt than previous generations. Being aware of potential pitfalls can help you avoid accumulating unmanageable debt during your college years.

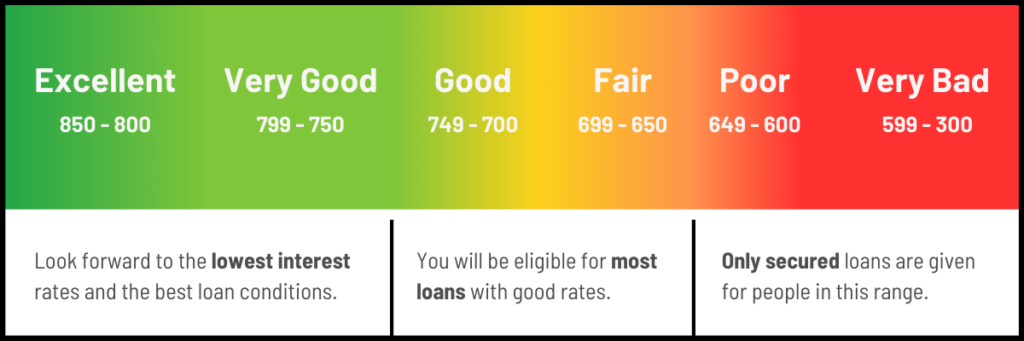

- Credit Score Impact: Your credit score can influence your ability to secure loans and your interest rates. A higher credit score can save you thousands of dollars in interest over your lifetime.

Now, let’s dive into actionable steps to help you build your credit during your college journey.

Get a Credit Card (Responsibly)

Obtaining a credit card can be a valuable tool for building credit. However, it’s essential to use it responsibly:

- Student Credit Cards: Many banks offer student-specific credit cards with lower credit limits and tailored benefits. These can be a great entry point.

- Pay on Time: Make sure to pay your credit card bill on time, as your payment history significantly impacts your credit score.

Be Mindful of Your Credit Utilization

Your credit utilization ratio—how much credit you’re using compared to your total credit limit—is a crucial factor in your credit score. Aim to keep your utilization below 30% to demonstrate responsible credit management.

Consider Becoming an Authorized User

If you’re hesitant about getting your own credit card, you can ask a family member to add you as an authorized user on their card. Their positive credit history can benefit your score.

Keep an Eye on Your Credit Report

Regularly monitor your credit report for errors or suspicious activity. You can obtain a free credit report annually from each of the three major credit bureaus. Correcting errors promptly can prevent future headaches.

Set Up a Budget

Budgeting is a valuable skill that can help you manage your finances effectively. Tools like budgeting apps can make this task more manageable.

Sign Up for RentPlus to Build Credit

One innovative way to build credit is through RentPlus, a service designed to report your rent payments to credit bureaus. This can help you establish a positive credit history without taking on additional debt.

The Future Benefits of Credit Building

While the immediate rewards of building credit may not be apparent, it’s an investment in your future financial well-being. By establishing good credit habits in college, you can:

- Reduce Financial Stress: A strong credit history can make it easier to access financial resources in times of need, reducing the stress associated with unexpected expenses.

- Avoid Debt Traps: Good credit can help you secure loans with lower interest rates, preventing you from falling into debt traps with exorbitant interest charges.

- Set Yourself Up for Success: As you approach graduation, you’ll have a solid financial foundation and a credit score that opens doors to opportunities like renting an apartment or applying for a job.

In conclusion, building credit in college is a strategic move that can pay dividends in the long run. By following these tips, you’ll be well on your way to establishing a strong credit history and ensuring a brighter financial future. So, take the first step, start building your credit today, and consider signing up for RentPlus to accelerate your journey to financial success. Your future self will thank you for it.